SINGAPORE: Office buildings in the city fringes may be increasingly left vacant as tenants seek the opportunity to move into Grade A premises in the Central Business District (CBD) with rents weakening amid an onslaught of incoming supply.

Pundits, such as Bloomberg columnist Andy Mukherjee, have blamed the weak office market here on a “fundamental miscalculation” on the part of some Singapore developers that had “misplaced optimism” that China would sustain its rapid pace of its growth and pull the rest of Asia along.

With another 7 million square feet of new office space under construction at a time when businesses are holding back expansion plans, rents in Singapore will continue to tumble, analysts warned. Mr Nicholas Mak, executive director at SLP International Property Consultants, has forecast a 10 to 15 per cent fall in rents this year, accelerating from the 6.5 per cent decline last year.

“In the past six months, we have already seen a noticeable slowdown in demand (for offices). The financial services industry has been the main demand driver but that has been the biggest weakness in the last few years,” said Mr Desmond Sim, head of CBRE Research in Singapore and Southeast Asia.

As of the end of last year, Grade A office rents in the CBD cost between S$8.00 and S$12.80 psf, according to a report by property firm Knight Frank Singapore. Those outside the CBD but still within Singapore’s central areas fetched S$7.50 to S$11.90 psf, while rents for offices in the city fringes and suburbs ranged from S$4.40-S$8.10 psf.

Competition for tenants is intensifying, with landlords offering attractive renewal terms to retain existing tenants, said Ms Louise Toovey, director of office agency at Knight Frank. They are also more willing to extend competitive rental rates to new tenants and offer additional incentives such as a rent-free period within the lease, she added.

The landlords’ willingness to lower rents have already resulted in several flight-to-quality cases. Online travel company Expedia vacated its Hong Kong Street premises for space in the recently-completed South Beach Tower. Immigration services provider Fragomen also moved into South Beach Tower from Haw Par Glass Tower, real estate consultancies Colliers International and Knight Frank reported. But with fewer companies expanding and fewer new companies being set up, this phenomenon comes at the expense of older, less attractive buildings.

“Flight-to-quality will definitely leave voids in other markets. The non-beneficiaries are buildings that are functionally-challenged – smaller floor plates, pencil-thin buildings or very, very aged buildings. This might encourage some sort of regeneration to keep these buildings up-to-scratch. Regeneration could even come in a change of use,” Mr Sim said.

This also means that islandwide office vacancy rates will likely soar past the current 9.5 per cent, as almost 4 million sq ft of the estimated 7 million sq ft of supply is due for completion in the second half of this year. Signs of rising vacancy are clear, analysts said, citing Tanjong Pagar Centre as an example of slower demand for offices. At 290 metres, the prestigious mixed-use development will be Singapore’s tallest building when completed later this year, but it has secured barely 10 per cent of lease commitments for its 890,000 sq ft of office space. Other major developments set to enter the market include Marina One and DUO Tower, which will add more than 2 million sq ft of office space.

In response to TODAY’s query on the take-up rates of Marina One and DUO, developer M+S would only say that it is seeing “healthy interest” and “various tenants have pre-committed” to both projects. Property analysts said that the days of quick supply absorption are well over and the current weak market could take as long as five years to recover even as land supply for commercial development has been scaled back.

“It is bad enough. Supply is at record high this year at a time when companies are downsizing and merging,” said Mr Ku Swee Yong, chief executive of property firm Century 21. “Good or bad market, there should have been a controlled but steady supply of land. Controlled, meaning the developers shouldn’t have been so excessive. The Government may have been excessive in releasing land through GLS (Government Land Sales programme), but its premise is that with more land, there can be better control of prices,” he added.

CIMB Private Banking economist Song Seng Wun said that regardless of macroeconomic conditions, the Government has taken a deliberate approach to have supply exceed potential take-up. “Today’s demand may be softer than earlier projected, but this is part and parcel of any cyclical market. It’s always difficult to predict,” he said.

Services

Stakeholder mapping, analysis, engagement and communication needs to be detailed to avoid business losses or even worse, a crisis. How can you do this effectively to prevent failure? ...

Data-driven business decisions have never been as crucial, especially in this era. MGBF leverages off, technology, experience and market presence to aid businesses in making accurate decisions. ...

MGBF provides comprehensive strategic advice and results-focused solutions to solve clients' problems in business-government relations so they can focus on their core business. ...

A critical business challenge is meeting the right decision-makers and potential buyers through the best channel and platform. How will you improve your business competency? ...

Upcoming Events

In this episode of 'A Working Lunch with Nordin', MGBF's Nordin Abdullah and regional commentator Eddin Khoo will discuss the biggest threats and opportunities for businesses as we look to manage change in the South China Sea.

This MGBF Roundtable will feature thought leaders form Japan, Australia, Singapore and Malaysia dealing with the critical issues of manipulation of public listed companies and government and their financial impacts.

A series of networking sessions with various business associations and trade organisations exploring high-value opportunities for business leaders and entrepreneurs looking to build the relationships that matter.

This integrated event will include a forum, dedicated business matching, site visits, a gala dinner and a round of golf. Aptly themed, the focus will be on regional food security issues and trends in the context of the supply chain, agriculture technology and trade regulations and policies.

MGBF In The News

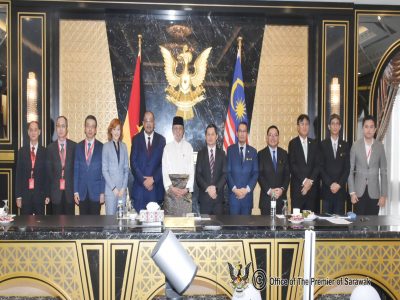

Planet QEOS and China Machinery Engineering Corporation (CMEC) are interested in investing RM10 billion to co-develop advanced Megawatt peak (MWp) agrovoltaic in Baram, to further boost Sarawak’s green energy initiative and food security. Sarawak Premier Datuk Patinggi Tan Sri Abang Johari Tun Openg was briefed on Friday by both the […]

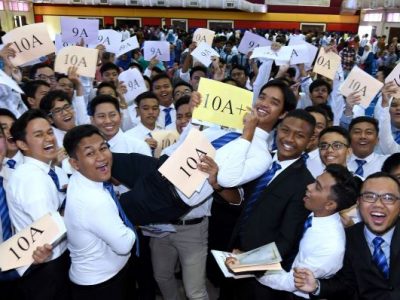

Last week SPM results came out, 373,974 aspirants who have been waiting patiently over the last few months would now know their fate. Some 10,109 have received all A’s, the golden standard of academic success and the ticket to those looking to study the “more advanced” subjects in university. Proudly, […]

The classic knee-jerk reaction is to say, fire the coach, change the leadership of associations, and reduce the funding till they start performing better. This kind of negative reinforcement may work for kindergarten children, but we are dealing with high-performance adults – individuals much further along in their psychological and […]

Since its earliest tea plantations in 1929, Cameron Highlands has grown to become a key player in the agricultural landscape of Malaysia, producing 40 per cent of all vegetables grown. Despite Malaysia shifting its economic focus away from agriculture, the industry remains imperative for food security and the livelihoods of […]

Although at first glance the travel industry and the agricultural sector appear to have nothing in common, they actually share more than meets the eye. The economic benefits of tourism to the agricultural sector can be multiplied several times over. “Tourism brings the end consumers closer to the source, which […]

The Malaysia Global Business Forum (MGBF) recently held a high-level roundtable themed ‘Designing the Future of the Digital Economy’, attended by industry leaders and business associations. The guest of honour was Yang Berhormat Syerleena Abdul Rashid, the Member of Parliament (MP) for Bukit Bendera in Penang. The MP’s Special Session […]

The Malaysia Global Business Forum (MGBF) will be hosting a roundtable on ‘Designing the Future of the Digital Economy’ on 23 February 2023. It is the culmination of the first three MGBF Exclusive Roundtable Series titled ‘The Evolving Threat Matrix in the Digital Economy’ held throughout 2022. According to the […]

The Founding Chairman of the Malaysia Global Business Forum (MGBF), Nordin Abdullah, today spoke on Bernama TV’s leading English talk show, The Brief, hosted by Jessy Chahal, on the topic of a stable political reality and what that means for the Malaysian economy. Nordin said, “The first thing that it […]

More than 1,100 years ago, Muhammad ibn Musa al-Khwarizmi was developing the mathematical formulas that we know today as algorithms which now have become so intertwined with the business fortunes of global media giants and the very fabric of geopolitics. A series of recent high level international reports have revealed […]

KSK Land has been recognised by the Malaysia Global Business Forum (MGBF) for its role in attracting high net-worth individuals to Malaysia post-pandemic. The first challenge in investor attraction is “selling” the country. In the context of Asia, Malaysia is competing with some very established investment destinations. The second […]

Malaysia, in particular Kuala Lumpur, continues to position itself as a regional centre to do business, educate a family and enjoy a global lifestyle. One company, KSK Land, has taken the lead in positioning itself and the city of Kuala Lumpur as a property investment destination for the global citizen […]

The upcoming budget represents an opportunity to build resilience in the critical sectors that will form the backbone of the country’s future-facing economic ambitions. This however needs to be achieved in the context of managing the community sectors most impacted by COVID-19 over the past two years. The Keluarga Malaysia (Malaysian Family) […]

Malaysia Global Business Forum (MGBF) has moved to support the creative economy as the overall economy moves into a recovery phase following the COVID19 pandemic. As a step in the direction of normalcy, the MGBF has agreed to host the art exhibition “I Know You’re Somewhere So Far” by one […]

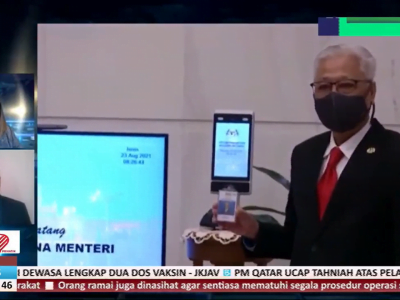

Congratulations to Datuk Seri Ismail Sabri Yaakob for taking up the mantle of the ninth prime minister of Malaysia. There is nothing normal about the situation; it could not have been scripted but it has kept the spectrum of media, mainstream and social, gripped. The first order of business for […]

In a stirring speech to the nation, President Joseph R. Biden, Jr. stamped his brand of leadership on the presidency, in his first act as the 46th president of the United State of America, it signaled several shifts. Perhaps the weather was foreboding with snow falling before the ceremony that […]

KUALA LUMPUR, 6 July 2022 – As the global economy continues to deal with unprecedented levels of disruption caused by the pandemic and the conflict between Russia and Ukraine, the convergence of energy security and food security issues has become a front-of-mind issue faced by policy makers and consumers alike. […]

KUALA LUMPUR, 23 June 2022 — Malaysia Global Business Forum (MGBF) ties up with scoutAsia to ensure that businesses are equipped with deeper regional insights. The past two years has seen a massive shift in the way businesses are conducted with digitisation, digitalisation and automation continuously being adopted to improve […]

KUALA LUMPUR, 25 May 2022 – The Malaysia Global Business Forum (MGBF)’s exclusive roundtable on ‘Security Concerns in Critical Value Chains’ was held in a hybrid setting yesterday at the Eastin Hotel Kuala Lumpur. The guest of honour was Yang Berbahagia Tan Sri Dato’ Seri Rafidah Aziz, former minister of […]

We live in the age of crisis. At the heart of any crisis is the threat of rapid change. Change too deep or too wide that the current coping mechanisms for an individual, corporation or government are unable to remain resilient. An unwelcome paradigm shift, like the proverbial spider, that […]