Xapo Bank highlights strong appetite since enabling USDC deposits in November, receiving $48 Million in USDC deposits and enabling $4.5M in USDC withdrawals since the function went live in March*

BANGKOK, THAILAND –

Media OutReach – 16 May 2023 –

Xapo Bank, a fully licensed private bank that combines traditional banking with access to Bitcoin and stablecoins, has become the first bank in the world to integrate Tether (

USDT) payment rails. Beginning with a phased roll out, the payment rails will be fully available to all members by the end of the month. Building on its existing

USDC rails that were launched in March, the bank is now enabling members to leverage the world’s most widely adopted stablecoin for payments as an alternative to time-consuming and costly SWIFT rails.

With a market cap of $82 billion USD**, USDT is the world’s most used stablecoin and one of the most traded cryptocurrencies by volume, having pioneered the digital dollar concept. It empowers growing ventures and innovation throughout the blockchain space, providing a quicker and more efficient way for millions of people across the globe to send and receive money for remittances and other payments. It is also particularly

popular in emerging markets suffering from hyperinflation and economic uncertainty.

Xapo Bank has seen a strong appetite for the efficiency of stablecoin deposits and withdrawals amongst its members, many of whom are based in emerging markets. Since enabling USDC deposits in November, it has received $48 Million in USDC deposits and enabled $4.5M in USDC withdrawals since the function went live in March. It has also experienced a 19%*** increase in member onboarding requests since the USDC withdrawal function went live in March.

By allowing members to deposit and withdraw using USDT with no fees charged, Xapo Bank is bringing its attractive 4.1% annual interest rate return on deposits to the attention of a new cohort of potential members looking for an alternative to SWIFT payments. Similarly to its USDC offering, Xapo Bank offers a 1:1 conversion rate from USDT to USD. All USDT deposits received by Xapo Bank are automatically converted to USD, meaning that members can benefit from a 4.1% annual interest rate on USD deposits.

A fully licensed and regulated bank, Xapo Bank is a member of the Gibraltar Deposit Guarantee Scheme, meaning that Xapo Bank guarantees its members’ USD deposits up to the US dollar equivalent of €100,000. Xapo Bank does not take any risks with deposits received using USDT. All such deposits are automatically converted to USD and deposited into the member’s account. Unlike traditional banks, Xapo Bank does not lend and therefore does not rely on fractional reserve banking to make money as its core business model. Instead, it has all its customers’ funds in reserve and invested in short-term liquid assets to pass the benefit of that interest earned to its customers.

Seamus Rocca, CEO of Xapo Bank, said:

“Xapo Bank is the only regulated bank in the world which offers a USD account with stablecoin rails. This unique offering combines the compliance and safety of a traditional bank with the speed, efficiency and breadth of use of USDT. By growing our payment rail options, we are committed to eliminating the timely and often expensive deposit and withdrawal processes into regular banks. We are empowering our members to grow their wealth and access and spend it seamlessly.” Xapo Bank is constantly striving to grow its payment rails options, offering members additional currency choices managed with the security of a fully-regulated Bank. Reflecting this, in addition to the USDC and USDT payment rails, Xapo Bank previously integrated with the

Faster Payment System (FPS) to activate support for GBP settlement for account deposits and withdrawals. Earlier this month, it also announced an integration with Bitcoin’s Lightning Network, in collaboration with Lightspark.

To learn more about Xapo Bank visit:

https://www.xapo.com/ Editor’s Notes * Data collated w/c 25th April

** As of 9th May

*** Comparing the 45 days before the USDC launch and 45 days after the launch

Hashtag: #XapoBank

https://www.linkedin.com/company/xapoprivatebank/?originalSubdomain=gi

https://www.linkedin.com/company/xapoprivatebank/?originalSubdomain=gi https://www.facebook.com/xapoprivatebank/

https://www.facebook.com/xapoprivatebank/ https://www.instagram.com/xapoprivatebank/

https://www.instagram.com/xapoprivatebank/The issuer is solely responsible for the content of this announcement.

About Xapo Bank

Xapo Bank is a fully licensed private bank that combines traditional banking with access to Bitcoin and stablecoins. Founded in 2013, Xapo became one of the most trusted Bitcoin custodians in the industry, providing users with a secure platform to store and transact with their cryptocurrency. Coinbase‘s custody arm purchased Xapo’s institutional custody business in 2019. Pivoting to service solely retail customers, it evolved into Xapo Bank, the first crypto company in the world to obtain a banking license, issued and regulated by the Gibraltar Financial Services Commission. It has since expanded its offerings to include a full suite of private banking services. With this expansion, Xapo Bank is poised to become one of the leading private banks in the world, offering clients a level of security, privacy, and flexibility that is unmatched in the traditional banking industry.

Xapo Bank is a fully licensed private bank that combines traditional banking with access to Bitcoin and stablecoins. Founded in 2013, Xapo became one of the most trusted Bitcoin custodians in the industry, providing users with a secure platform to store and transact with their cryptocurrency. Coinbase‘s custody arm purchased Xapo’s institutional custody business in 2019. Pivoting to service solely retail customers, it evolved into Xapo Bank, the first crypto company in the world to obtain a banking license, issued and regulated by the Gibraltar Financial Services Commission. It has since expanded its offerings to include a full suite of private banking services. With this expansion, Xapo Bank is poised to become one of the leading private banks in the world, offering clients a level of security, privacy, and flexibility that is unmatched in the traditional banking industry.

Services

Stakeholder mapping, analysis, engagement and communication needs to be detailed to avoid business losses or even worse, a crisis. How can you do this effectively to prevent failure? ...

Data-driven business decisions have never been as crucial, especially in this era. MGBF leverages off, technology, experience and market presence to aid businesses in making accurate decisions. ...

MGBF provides comprehensive strategic advice and results-focused solutions to solve clients' problems in business-government relations so they can focus on their core business. ...

A critical business challenge is meeting the right decision-makers and potential buyers through the best channel and platform. How will you improve your business competency? ...

Upcoming Events

In this episode of 'A Working Lunch with Nordin', MGBF's Nordin Abdullah and regional commentator Eddin Khoo will discuss the biggest threats and opportunities for businesses as we look to manage change in the South China Sea.

This MGBF Roundtable will feature thought leaders form Japan, Australia, Singapore and Malaysia dealing with the critical issues of manipulation of public listed companies and government and their financial impacts.

A series of networking sessions with various business associations and trade organisations exploring high-value opportunities for business leaders and entrepreneurs looking to build the relationships that matter.

This integrated event will include a forum, dedicated business matching, site visits, a gala dinner and a round of golf. Aptly themed, the focus will be on regional food security issues and trends in the context of the supply chain, agriculture technology and trade regulations and policies.

MGBF In The News

Planet QEOS and China Machinery Engineering Corporation (CMEC) are interested in investing RM10 billion to co-develop advanced Megawatt peak (MWp) agrovoltaic in Baram, to further boost Sarawak’s green energy initiative and food security. Sarawak Premier Datuk Patinggi Tan Sri Abang Johari Tun Openg was briefed on Friday by both the […]

Last week SPM results came out, 373,974 aspirants who have been waiting patiently over the last few months would now know their fate. Some 10,109 have received all A’s, the golden standard of academic success and the ticket to those looking to study the “more advanced” subjects in university. Proudly, […]

The classic knee-jerk reaction is to say, fire the coach, change the leadership of associations, and reduce the funding till they start performing better. This kind of negative reinforcement may work for kindergarten children, but we are dealing with high-performance adults – individuals much further along in their psychological and […]

Since its earliest tea plantations in 1929, Cameron Highlands has grown to become a key player in the agricultural landscape of Malaysia, producing 40 per cent of all vegetables grown. Despite Malaysia shifting its economic focus away from agriculture, the industry remains imperative for food security and the livelihoods of […]

Although at first glance the travel industry and the agricultural sector appear to have nothing in common, they actually share more than meets the eye. The economic benefits of tourism to the agricultural sector can be multiplied several times over. “Tourism brings the end consumers closer to the source, which […]

The Malaysia Global Business Forum (MGBF) recently held a high-level roundtable themed ‘Designing the Future of the Digital Economy’, attended by industry leaders and business associations. The guest of honour was Yang Berhormat Syerleena Abdul Rashid, the Member of Parliament (MP) for Bukit Bendera in Penang. The MP’s Special Session […]

The Malaysia Global Business Forum (MGBF) will be hosting a roundtable on ‘Designing the Future of the Digital Economy’ on 23 February 2023. It is the culmination of the first three MGBF Exclusive Roundtable Series titled ‘The Evolving Threat Matrix in the Digital Economy’ held throughout 2022. According to the […]

The Founding Chairman of the Malaysia Global Business Forum (MGBF), Nordin Abdullah, today spoke on Bernama TV’s leading English talk show, The Brief, hosted by Jessy Chahal, on the topic of a stable political reality and what that means for the Malaysian economy. Nordin said, “The first thing that it […]

More than 1,100 years ago, Muhammad ibn Musa al-Khwarizmi was developing the mathematical formulas that we know today as algorithms which now have become so intertwined with the business fortunes of global media giants and the very fabric of geopolitics. A series of recent high level international reports have revealed […]

KSK Land has been recognised by the Malaysia Global Business Forum (MGBF) for its role in attracting high net-worth individuals to Malaysia post-pandemic. The first challenge in investor attraction is “selling” the country. In the context of Asia, Malaysia is competing with some very established investment destinations. The second […]

Malaysia, in particular Kuala Lumpur, continues to position itself as a regional centre to do business, educate a family and enjoy a global lifestyle. One company, KSK Land, has taken the lead in positioning itself and the city of Kuala Lumpur as a property investment destination for the global citizen […]

The upcoming budget represents an opportunity to build resilience in the critical sectors that will form the backbone of the country’s future-facing economic ambitions. This however needs to be achieved in the context of managing the community sectors most impacted by COVID-19 over the past two years. The Keluarga Malaysia (Malaysian Family) […]

Malaysia Global Business Forum (MGBF) has moved to support the creative economy as the overall economy moves into a recovery phase following the COVID19 pandemic. As a step in the direction of normalcy, the MGBF has agreed to host the art exhibition “I Know You’re Somewhere So Far” by one […]

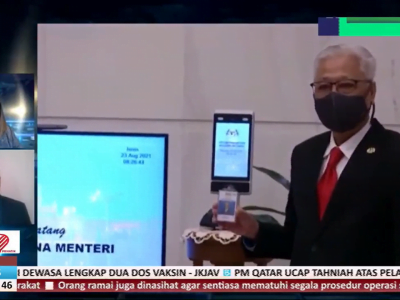

Congratulations to Datuk Seri Ismail Sabri Yaakob for taking up the mantle of the ninth prime minister of Malaysia. There is nothing normal about the situation; it could not have been scripted but it has kept the spectrum of media, mainstream and social, gripped. The first order of business for […]

In a stirring speech to the nation, President Joseph R. Biden, Jr. stamped his brand of leadership on the presidency, in his first act as the 46th president of the United State of America, it signaled several shifts. Perhaps the weather was foreboding with snow falling before the ceremony that […]

KUALA LUMPUR, 6 July 2022 – As the global economy continues to deal with unprecedented levels of disruption caused by the pandemic and the conflict between Russia and Ukraine, the convergence of energy security and food security issues has become a front-of-mind issue faced by policy makers and consumers alike. […]

KUALA LUMPUR, 23 June 2022 — Malaysia Global Business Forum (MGBF) ties up with scoutAsia to ensure that businesses are equipped with deeper regional insights. The past two years has seen a massive shift in the way businesses are conducted with digitisation, digitalisation and automation continuously being adopted to improve […]

KUALA LUMPUR, 25 May 2022 – The Malaysia Global Business Forum (MGBF)’s exclusive roundtable on ‘Security Concerns in Critical Value Chains’ was held in a hybrid setting yesterday at the Eastin Hotel Kuala Lumpur. The guest of honour was Yang Berbahagia Tan Sri Dato’ Seri Rafidah Aziz, former minister of […]

We live in the age of crisis. At the heart of any crisis is the threat of rapid change. Change too deep or too wide that the current coping mechanisms for an individual, corporation or government are unable to remain resilient. An unwelcome paradigm shift, like the proverbial spider, that […]

![]() Xapo Bank is a fully licensed private bank that combines traditional banking with access to Bitcoin and stablecoins. Founded in 2013, Xapo became one of the most trusted Bitcoin custodians in the industry, providing users with a secure platform to store and transact with their cryptocurrency. Coinbase‘s custody arm purchased Xapo’s institutional custody business in 2019. Pivoting to service solely retail customers, it evolved into Xapo Bank, the first crypto company in the world to obtain a banking license, issued and regulated by the Gibraltar Financial Services Commission. It has since expanded its offerings to include a full suite of private banking services. With this expansion, Xapo Bank is poised to become one of the leading private banks in the world, offering clients a level of security, privacy, and flexibility that is unmatched in the traditional banking industry.

Xapo Bank is a fully licensed private bank that combines traditional banking with access to Bitcoin and stablecoins. Founded in 2013, Xapo became one of the most trusted Bitcoin custodians in the industry, providing users with a secure platform to store and transact with their cryptocurrency. Coinbase‘s custody arm purchased Xapo’s institutional custody business in 2019. Pivoting to service solely retail customers, it evolved into Xapo Bank, the first crypto company in the world to obtain a banking license, issued and regulated by the Gibraltar Financial Services Commission. It has since expanded its offerings to include a full suite of private banking services. With this expansion, Xapo Bank is poised to become one of the leading private banks in the world, offering clients a level of security, privacy, and flexibility that is unmatched in the traditional banking industry.