Kuala Lumpur, 31st July, 2017, In recent years the dedicated Hajj and Umrah flight operator has gained the attention of the public and of late the regulators as it aims to build a uniquely Malaysian airline that helps people from around the world perform their religious duties.

In this independent report the MGBF research team which has been tracking the airline’s performance from its establishment examines the achievements of Eaglexpress over the past five years and explores how Eaglexpress can “Fly above the turbulence” of the current situation to ensure the sustainable future of the airline.

In this independent report the MGBF research team which has been tracking the airline’s performance from its establishment examines the achievements of Eaglexpress over the past five years and explores how Eaglexpress can “Fly above the turbulence” of the current situation to ensure the sustainable future of the airline.

As reported in the Star online business section on the 31st December 2016 “Umrah and Hajj is a billion-dollar business globally and several airlines worldwide offer charters but many more depend on charter carriers like Eaglexpress to carry pilgrims.” The gap in the market that Eaglexpress fills globally is the need to move large amounts of passengers beyond the capability of regularly scheduled flights.

Malaysia too will need increased capacity on the back of the recent announcement by the Saudi Arabian government reported in the Arab News on 26th of February, 2017 that the quota would be increased from “some 27,000 pilgrims come annually from Malaysia and that will be increased to 30,000”

The Kingdom of Saudi Arabia’s Vision 2030 clearly states “increase our capacity to welcome Umrah and Hajj visitors from 8 million to 30 million every year” this will require increased capacity especially in the airline sector. At the same time, the Saudi Commission for Tourism and Heritage announced the National Strategy for Sustainable Tourism which included the “Umrah Plus Tourism Market”, which would see millions of Muslims extend stays in the Kingdom following the performance of Umrah.

This bodes well for Eaglexpress as technically they would be able to operate flights out of Malaysia under their own call sign and able to provide “wet leased” aircraft to fly from any Muslim country during peak times as created during Hajj and Umrah seasons throughout the various times in the year to meet the capacity required to move the millions of proposed passengers.

Eaglexpress was established on in 2012, with an initial paid up capital of RM5 Million. The company was established to meet the “social service” of flying pilgrims from the Muslim world to Saudi Arabia for Hajj and Umrah. Since that date it was able to generate over USD400 Million in foreign earnings for Malaysia. The airline also has a valid IATA Operational Safety Audit (IOSA) certificate, one of three operators in the country to do so.

Until very recently Eaglexpress was operating mostly international business and the fact that it was able to maintain an excellent record with international regulators and safety compliance organisations which is a critical success factor. This is a key organisational strength of Eaglexpress as new entrants to the market will face challenges meeting the same requirements.

Eaglexpress is working with international suppliers of aircraft to find innovative way to reduce the social impact of waiting list for Hajj upwards of 15 years in Malaysia, a country renowned for its Hajj operations. Reduced cost and increased capacity that can only be achieved with the correct configurations and other cost efficiencies, this will have a positive impact on consumers.

Eaglexpress is a uniquely Bumi company that has been operating under its own capacity since inception. However looking at the size of the global opportunity it is time for Eaglexpress to consider partnering with or being adopted by a Malaysian Government Linked Company (GLC) to empower the next stage of growth.

The airline was thrown into crisis when Malaysian authorities revoked its Air Services Permit (ASP) was revoked while it was undergoing a RM38 million contract to carry 25,000 pilgrims for Umrah from Malaysia. This has now become the focus of a judicial review as the position of Eaglexpress is that they were not given fair warning or natural justice, especially as the airline at that time was already operating for 5 years. This created a knock on effect, the Foreign Operator Certificate (FOC) issued by the Saudi authority to undertake the Umrah contract under its own call sign was put on hold. The cumulative business loses will reach well over USD100 Million.

Eaglexpress maintains that it is able to operate both from an organisation and safety perceptive this business, and wishes that government authorities had played a role of facilitation rather than the course taken.

Moving forward, Eaglexpress is well placed to establish a vendor development program especially for Bumi SME’s to supply of halal food and suitable entertainment content on the 9 hour flight to Saudi Arabia. Coupled with providing reduced cargo prices for Malaysian products to Saudi Arabia, this would have a positive economic knock on effect to local SME’s and create an estimated 1,000 jobs.

Eaglexpress has not fully capitalised on the goodwill that was created due to the company’s role in housing the Malaysian evacuees from the Yemen crisis, which was not widely reported in the media at the time. Nor the company’s strong social responsibility culture having employed many single mothers and those staff laid off by other airlines in the country. This needs to be communicated to the public together with the fact that Eaglexpress in a social responsibility that is realised through the business of Umrah and Hajj flight operations.

Eaglexpress currently position in Malaysia, has seen regional investors looking to invest directly into the company to take advantage of the growth in the global Umrah and Hajj business, especially in key markets of Africa, Middle East and Greater Asia. Markets which currently see many non-Muslim companies leading the way in supply of aircraft.

Moving forward Eaglexpress will attract both investors and linkages with key government linked companies as the opportunity has increased so to should the involvement of the government of Malaysia to ensure that the country can remain in a leading position in the Haj and Umrah business.

From the small beginnings the management and staff of Eaglexpress can be proud of being able to operate in this segment of the market for so long. Now they must chart a future for the company which includes a flight path above the turbulence of the current situation.

For further research on the company contact the MGBF research team

Services

Stakeholder mapping, analysis, engagement and communication needs to be detailed to avoid business losses or even worse, a crisis. How can you do this effectively to prevent failure? ...

Data-driven business decisions have never been as crucial, especially in this era. MGBF leverages off, technology, experience and market presence to aid businesses in making accurate decisions. ...

MGBF provides comprehensive strategic advice and results-focused solutions to solve clients' problems in business-government relations so they can focus on their core business. ...

A critical business challenge is meeting the right decision-makers and potential buyers through the best channel and platform. How will you improve your business competency? ...

Upcoming Events

MGBF founding chairman Nordin Abdullah and UMW Toyota president Datuk Ravindran K. will delve into the convergence of automotive innovation and environmental sustainability in Penang, Sarawak, Johor and Pahang.

In this episode of 'A Working Lunch with Nordin', MGBF's founding chairman, Nordin Abdullah, will host this discussion focusing on the biggest threats and opportunities for businesses as we look to manage change in the South China Sea.

This MGBF Roundtable will focus on regional food security issues and trends in the regional supply chain, and trade regulations and policies, including a new geopolitical tool i.e., weaponisation of supply chains.

This integrated event will include a forum, dedicated business matching, site visits, a gala dinner and a round of golf. Aptly themed, the focus will be on regional food security issues and trends in the context of the supply chain, agriculture technology and trade regulations and policies.

MGBF In The News

Planet QEOS, KIS BlOCNG San Bhd, and the Sarawak Land Consolidation and Rehabilitation Authority (SALCRA) have officially signed a tripartite memorandum of understanding (MoU) to establish a collaborative framework aimed at producing bio-hydrogen via the Steam Biomethane Reforming (SBMR) Process. The MoU was signed by Planet QEOS executive chairman Dino […]

Planet QEOS and China Machinery Engineering Corporation (CMEC) are interested in investing RM10 billion to co-develop advanced Megawatt peak (MWp) agrovoltaic in Baram, to further boost Sarawak’s green energy initiative and food security. Sarawak Premier Datuk Patinggi Tan Sri Abang Johari Tun Openg was briefed on Friday by both the […]

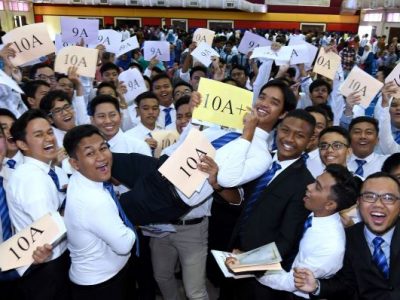

Last week SPM results came out, 373,974 aspirants who have been waiting patiently over the last few months would now know their fate. Some 10,109 have received all A’s, the golden standard of academic success and the ticket to those looking to study the “more advanced” subjects in university. Proudly, […]

The classic knee-jerk reaction is to say, fire the coach, change the leadership of associations, and reduce the funding till they start performing better. This kind of negative reinforcement may work for kindergarten children, but we are dealing with high-performance adults – individuals much further along in their psychological and […]

Since its earliest tea plantations in 1929, Cameron Highlands has grown to become a key player in the agricultural landscape of Malaysia, producing 40 per cent of all vegetables grown. Despite Malaysia shifting its economic focus away from agriculture, the industry remains imperative for food security and the livelihoods of […]

Although at first glance the travel industry and the agricultural sector appear to have nothing in common, they actually share more than meets the eye. The economic benefits of tourism to the agricultural sector can be multiplied several times over. “Tourism brings the end consumers closer to the source, which […]

The Malaysia Global Business Forum (MGBF) recently held a high-level roundtable themed ‘Designing the Future of the Digital Economy’, attended by industry leaders and business associations. The guest of honour was Yang Berhormat Syerleena Abdul Rashid, the Member of Parliament (MP) for Bukit Bendera in Penang. The MP’s Special Session […]

The Malaysia Global Business Forum (MGBF) will be hosting a roundtable on ‘Designing the Future of the Digital Economy’ on 23 February 2023. It is the culmination of the first three MGBF Exclusive Roundtable Series titled ‘The Evolving Threat Matrix in the Digital Economy’ held throughout 2022. According to the […]

The Founding Chairman of the Malaysia Global Business Forum (MGBF), Nordin Abdullah, today spoke on Bernama TV’s leading English talk show, The Brief, hosted by Jessy Chahal, on the topic of a stable political reality and what that means for the Malaysian economy. Nordin said, “The first thing that it […]

More than 1,100 years ago, Muhammad ibn Musa al-Khwarizmi was developing the mathematical formulas that we know today as algorithms which now have become so intertwined with the business fortunes of global media giants and the very fabric of geopolitics. A series of recent high level international reports have revealed […]

KSK Land has been recognised by the Malaysia Global Business Forum (MGBF) for its role in attracting high net-worth individuals to Malaysia post-pandemic. The first challenge in investor attraction is “selling” the country. In the context of Asia, Malaysia is competing with some very established investment destinations. The second […]

Malaysia, in particular Kuala Lumpur, continues to position itself as a regional centre to do business, educate a family and enjoy a global lifestyle. One company, KSK Land, has taken the lead in positioning itself and the city of Kuala Lumpur as a property investment destination for the global citizen […]

The upcoming budget represents an opportunity to build resilience in the critical sectors that will form the backbone of the country’s future-facing economic ambitions. This however needs to be achieved in the context of managing the community sectors most impacted by COVID-19 over the past two years. The Keluarga Malaysia (Malaysian Family) […]

Malaysia Global Business Forum (MGBF) has moved to support the creative economy as the overall economy moves into a recovery phase following the COVID19 pandemic. As a step in the direction of normalcy, the MGBF has agreed to host the art exhibition “I Know You’re Somewhere So Far” by one […]

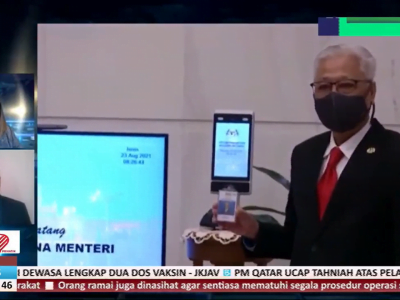

Congratulations to Datuk Seri Ismail Sabri Yaakob for taking up the mantle of the ninth prime minister of Malaysia. There is nothing normal about the situation; it could not have been scripted but it has kept the spectrum of media, mainstream and social, gripped. The first order of business for […]

In a stirring speech to the nation, President Joseph R. Biden, Jr. stamped his brand of leadership on the presidency, in his first act as the 46th president of the United State of America, it signaled several shifts. Perhaps the weather was foreboding with snow falling before the ceremony that […]

KUALA LUMPUR, 6 July 2022 – As the global economy continues to deal with unprecedented levels of disruption caused by the pandemic and the conflict between Russia and Ukraine, the convergence of energy security and food security issues has become a front-of-mind issue faced by policy makers and consumers alike. […]

KUALA LUMPUR, 23 June 2022 — Malaysia Global Business Forum (MGBF) ties up with scoutAsia to ensure that businesses are equipped with deeper regional insights. The past two years has seen a massive shift in the way businesses are conducted with digitisation, digitalisation and automation continuously being adopted to improve […]

KUALA LUMPUR, 25 May 2022 – The Malaysia Global Business Forum (MGBF)’s exclusive roundtable on ‘Security Concerns in Critical Value Chains’ was held in a hybrid setting yesterday at the Eastin Hotel Kuala Lumpur. The guest of honour was Yang Berbahagia Tan Sri Dato’ Seri Rafidah Aziz, former minister of […]

In this independent report the MGBF research team which has been tracking the airline’s performance from its establishment examines the achievements of Eaglexpress over the past five years and explores how Eaglexpress can “Fly above the turbulence” of the current situation to ensure the sustainable future of the airline.

In this independent report the MGBF research team which has been tracking the airline’s performance from its establishment examines the achievements of Eaglexpress over the past five years and explores how Eaglexpress can “Fly above the turbulence” of the current situation to ensure the sustainable future of the airline.