Up to 4.46% p.a. Projected Total Return Rate upon Policy Maturity

HONG KONG SAR –

Media OutReach – 19 April 2023 – Facing the complex and volatile economic situation, most customers would adopt more balanced strategies on wealth management. With competitive and steady returns, savings insurance can cater longer term of wealth management plan for customers, such as education fund for children and retirement reserve, etc. Hong Kong Life sincerely better arranges for customers by providing the premium discount of “Wealth Up Savings Insurance Plan” which allows customers enjoying higher potential returns.

From now until 30 June 2023, customers may enjoy up to 13% first year premium discount upon successful application of “Wealth Up Savings Insurance Plan” with fulfilment of specified first-year premium requirement and the policy being successfully issued. In addition, up to 5% Premium Prepayment Discount will be offered to customers if the second year premium is paid in advance together with the first year premium at the time of application. The Projected Total Return Rate can reach up to 4.46% p.a. upon Policy Maturity

1.

“Wealth Up Savings Insurance Plan” provides 20 years of savings and life protection with only 2-year premium payment. The Plan also offers premium prepayment arrangement, flexible death settlement options and simple application procedure with no medical examination required to meet the needs of different customers.

Mr. Jonathan Ko, Chief Marketing Officer of Hong Kong Life, said, “Hong Kong Life understands that customers would allocate their assets with various management tools to maximize the potential growth. Savings insurance is one of the common wealth management tools which provides steady returns and can better strive a balance between assets appreciation and financial risks. We have especially provided the premium discount of the ‘Wealth Up Savings Insurance Plan’, bringing up to 4.46% p.a. Projected Total Return Rate upon Policy Maturity to help customers achieving their wealth accumulation goals of medium-to-long term.”

Learn more about Wealth Up Savings Insurance Plan – Client Promotion Incentive :

https://www.hklife.com.hk/en/promotions/index-id-34.html Learn more about Wealth Up Savings Insurance Plan:

https://www.hklife.com.hk/en/products/personal-insurance/savings-plan/wealth-up-savings-insurance-plan/index.html Key Features of Wealth Up Savings Insurance Plan: - Short Premium Payment Term2 with 20-Year Life Protection

The Premium Payment Term

2 of the Plan is 2 years

2 only with 20 years life protection for the Life Insured.

- Premium Prepayment Arrangement3 to Build Your Wealth with Ease

You can prepay the premium for the second year at the time of application and enjoy the premium prepayment discount on the second year premium

3, so that you can build your wealth with ease.

- Additional Return to Build Your Wealth

The Plan not only provides Guaranteed Cash Value, Terminal Dividend (non-guaranteed)

4 may also be payable on or after the end of 5

th Policy Year when the Policy is fully surrendered by the Policyowner, upon the death of the Life Insured or upon Policy Maturity, whichever is earlier.

When the Policy is partially surrendered by the Policyowner, Terminal Dividend (non-guaranteed)

4 may be payable on or after the end of 5th Policy Year. The payable amount is equal to the Terminal Dividend (non-guaranteed)

4 attributable to the reduced portion of Principal Amount

5. Terminal Dividend (non-guaranteed)

4 will not accumulate in the Policy.

- Life Protection for Peace of Mind

When the Life Insured dies, the Total Death Benefit will be paid to the Beneficiary as below:

Policy Year

| Total Death Benefit

|

1 – 5

| 101% of Total Premiums Paid6

| less Indebtedness (if any).

|

6 – 20

| Applicable to the Life Insured

with issue age 70 or below:

105% of Total Premiums Paid6

OR

100% of Guaranteed Cash Value as at the date of death of the Life Insured (whichever is greater)

Applicable to the Life Insured

with issue age above 70:

101% of Total Premiums Paid6

OR

100% of Guaranteed Cash Value as at the date of death of the Life Insured (whichever is greater)

| plus Terminal Dividend (non-guaranteed)4(if any),less Indebtedness (if any).

|

- Flexible Death Settlement Options7

The Plan provides flexible Death Benefit Settlement Options

7. Instead of receiving the Death Benefit in a lump sum payment, Policyowner can designate other settlement options including Installment Payments (Fixed Amount) or Installment Payments (Fixed Period) while the Plan is in force and the Life Insured is alive to settle the Death Benefit to the Beneficiary.

- Fixed Premium for Your Better Planning

The premium will remain unchanged throughout the Premium Payment Term

2, allowing you to have a better plan for your future.

Application procedure is simple and no medical examination is required.

Terms and Conditions apply. For enquiries, please visit the branches of our Appointed Licensed Insurance Agency, including Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Wing Hang Bank Limited and Shanghai Commercial Bank Limited, or contact our Customer Service Hotline at (852) 2290 2882.

Note: - For the successful application of USD Policy, the projected total return rate is 4.46% p.a. (non-guaranteed) upon Policy Maturity, if no Policy Loan, no partial surrender, no withdrawal of Policy Value and all premiums have been paid when due during the benefit term, with the 13% discount on the first year premium of USD375,000 or above and the 5% discount on the second year premium prepayment which is paid in advance together with the first year premium at the time of application. Client incentive is subject to the terms and conditions of “Fascinating Rewards 2023” Client Promotion Incentive – Wealth Up Savings Insurance Plan. For details of client promotion incentive, please refer to : https://www.hklife.com.hk/en/promotions/index-id-34.html

- The Policy will be terminated if the Policyowner cannot settle the premium payment before the end of the Grace Period during the Premium Payment Term, subject to the Non-forfeiture Option and other relevant provisions of the Policy. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life. If the Policy is terminated before the Policy Maturity, the Total Surrender Value (if applicable) received by the Policyowner may be less than the Total Premiums Paid.

- When paying the first year premium, the second year annual premium may be deposited in advance into the Premium Deposit Account at the same time in order to be eligible for 4% (applicable to HKD Policy) or 5% (applicable to USD Policy) discount on the second year premium. If the premium is pre-paid in HKD for USD Policy, the pre-paid amount will be converted to USD based on the exchange rate as at the date of prepayment and deposited into the Premium Deposit Account for paying the second year premium. The amount in the Premium Deposit Account will be debited automatically to pay the premium on the premium due date of the 2nd Policy Year. No interest will be credited and no partial or full withdrawal is allowed for the amount in the Premium Deposit Account.

- Terminal Dividend is not guaranteed and may be changed from time to time. Past performance is not indicative of future performance. The actual amount payable may be higher or lower than those illustrated in the Insurance Proposal. Hong Kong Life reserves the right to change them from time to time.

- Principal Amount is used to calculate Initial Premium, any subsequent premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit. Any subsequent change of the Principal Amount will result in corresponding change in premium, benefits and policy values (if any) of the respective Basic Plan and any Supplementary Benefit. The Principal Amount does not represent the amount of death benefit of the respective Basic Plan and any Supplementary Benefit.

- Total Premiums Paid means the total amount of due and payable premiums from the Policy Date up to the date of termination of the Plan, paid to the Plan and received by Hong Kong Life. Any payment in excess of such amount of due and payable premiums will not be included in the Total Premiums Paid. In case of Partial Surrender, the Total Premiums Paid under the Policy shall be adjusted and reduced proportionally as specified in the Partial Surrender provisions. The Total Premiums Paid does not include the amount in the Premium Deposit Account. In the event of the death of Life Insured, the amount in the Premium Deposit Account (if any) will be paid to the Beneficiary. If Policyowner requests to surrender, the amount in the Premium Deposit Account (if any) will be returned to the Policyowner.

- Death Benefit Settlement Options are only applicable in the event of the death of the Life Insured after the Premium Payment Term and all premiums due have been paid, and subject to the terms and conditions, and the then administrative rules as determined by Hong Kong Life from time to time. For detailed terms and conditions, please refer to the policy document issued by Hong Kong Life.

Hashtag: #HongKongLife

https://www.facebook.com/hklifeinsurance/

https://www.facebook.com/hklifeinsurance/ https://www.instagram.com/hklifeinsurance/

https://www.instagram.com/hklifeinsurance/The issuer is solely responsible for the content of this announcement.

About Hong Kong Life

Established in 2001, Hong Kong Life Insurance Limited (“Hong Kong Life”) was founded by five local financial institutions including Asia Insurance Company Limited, Chong Hing Bank Limited, CMB Wing Lung Bank Limited, OCBC Wing Hang Bank Limited and Shanghai Commercial Bank Limited, which laid their foundations and have been serving people in Hong Kong for more than 50 years in average. Through our extensive network of around 130 distribution points comprising Chong Hing Bank, CMB Wing Lung Bank, OCBC Wing Hang Bank and Shanghai Commercial Bank, we provide a comprehensive range of insurance products and services.

Services

Stakeholder mapping, analysis, engagement and communication needs to be detailed to avoid business losses or even worse, a crisis. How can you do this effectively to prevent failure? ...

Data-driven business decisions have never been as crucial, especially in this era. MGBF leverages off, technology, experience and market presence to aid businesses in making accurate decisions. ...

MGBF provides comprehensive strategic advice and results-focused solutions to solve clients' problems in business-government relations so they can focus on their core business. ...

A critical business challenge is meeting the right decision-makers and potential buyers through the best channel and platform. How will you improve your business competency? ...

Upcoming Events

In this episode of 'A Working Lunch with Nordin', MGBF's Nordin Abdullah and regional commentator Eddin Khoo will discuss the biggest threats and opportunities for businesses as we look to manage change in the South China Sea.

This MGBF Roundtable will feature thought leaders form Japan, Australia, Singapore and Malaysia dealing with the critical issues of manipulation of public listed companies and government and their financial impacts.

A series of networking sessions with various business associations and trade organisations exploring high-value opportunities for business leaders and entrepreneurs looking to build the relationships that matter.

This integrated event will include a forum, dedicated business matching, site visits, a gala dinner and a round of golf. Aptly themed, the focus will be on regional food security issues and trends in the context of the supply chain, agriculture technology and trade regulations and policies.

MGBF In The News

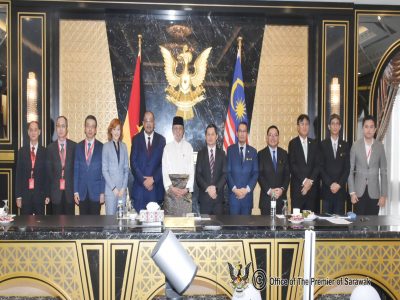

Planet QEOS and China Machinery Engineering Corporation (CMEC) are interested in investing RM10 billion to co-develop advanced Megawatt peak (MWp) agrovoltaic in Baram, to further boost Sarawak’s green energy initiative and food security. Sarawak Premier Datuk Patinggi Tan Sri Abang Johari Tun Openg was briefed on Friday by both the […]

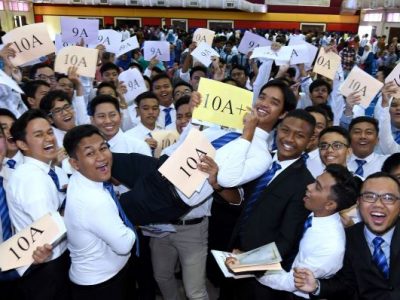

Last week SPM results came out, 373,974 aspirants who have been waiting patiently over the last few months would now know their fate. Some 10,109 have received all A’s, the golden standard of academic success and the ticket to those looking to study the “more advanced” subjects in university. Proudly, […]

The classic knee-jerk reaction is to say, fire the coach, change the leadership of associations, and reduce the funding till they start performing better. This kind of negative reinforcement may work for kindergarten children, but we are dealing with high-performance adults – individuals much further along in their psychological and […]

Since its earliest tea plantations in 1929, Cameron Highlands has grown to become a key player in the agricultural landscape of Malaysia, producing 40 per cent of all vegetables grown. Despite Malaysia shifting its economic focus away from agriculture, the industry remains imperative for food security and the livelihoods of […]

Although at first glance the travel industry and the agricultural sector appear to have nothing in common, they actually share more than meets the eye. The economic benefits of tourism to the agricultural sector can be multiplied several times over. “Tourism brings the end consumers closer to the source, which […]

The Malaysia Global Business Forum (MGBF) recently held a high-level roundtable themed ‘Designing the Future of the Digital Economy’, attended by industry leaders and business associations. The guest of honour was Yang Berhormat Syerleena Abdul Rashid, the Member of Parliament (MP) for Bukit Bendera in Penang. The MP’s Special Session […]

The Malaysia Global Business Forum (MGBF) will be hosting a roundtable on ‘Designing the Future of the Digital Economy’ on 23 February 2023. It is the culmination of the first three MGBF Exclusive Roundtable Series titled ‘The Evolving Threat Matrix in the Digital Economy’ held throughout 2022. According to the […]

The Founding Chairman of the Malaysia Global Business Forum (MGBF), Nordin Abdullah, today spoke on Bernama TV’s leading English talk show, The Brief, hosted by Jessy Chahal, on the topic of a stable political reality and what that means for the Malaysian economy. Nordin said, “The first thing that it […]

More than 1,100 years ago, Muhammad ibn Musa al-Khwarizmi was developing the mathematical formulas that we know today as algorithms which now have become so intertwined with the business fortunes of global media giants and the very fabric of geopolitics. A series of recent high level international reports have revealed […]

KSK Land has been recognised by the Malaysia Global Business Forum (MGBF) for its role in attracting high net-worth individuals to Malaysia post-pandemic. The first challenge in investor attraction is “selling” the country. In the context of Asia, Malaysia is competing with some very established investment destinations. The second […]

Malaysia, in particular Kuala Lumpur, continues to position itself as a regional centre to do business, educate a family and enjoy a global lifestyle. One company, KSK Land, has taken the lead in positioning itself and the city of Kuala Lumpur as a property investment destination for the global citizen […]

The upcoming budget represents an opportunity to build resilience in the critical sectors that will form the backbone of the country’s future-facing economic ambitions. This however needs to be achieved in the context of managing the community sectors most impacted by COVID-19 over the past two years. The Keluarga Malaysia (Malaysian Family) […]

Malaysia Global Business Forum (MGBF) has moved to support the creative economy as the overall economy moves into a recovery phase following the COVID19 pandemic. As a step in the direction of normalcy, the MGBF has agreed to host the art exhibition “I Know You’re Somewhere So Far” by one […]

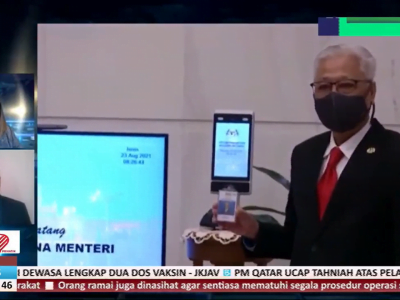

Congratulations to Datuk Seri Ismail Sabri Yaakob for taking up the mantle of the ninth prime minister of Malaysia. There is nothing normal about the situation; it could not have been scripted but it has kept the spectrum of media, mainstream and social, gripped. The first order of business for […]

In a stirring speech to the nation, President Joseph R. Biden, Jr. stamped his brand of leadership on the presidency, in his first act as the 46th president of the United State of America, it signaled several shifts. Perhaps the weather was foreboding with snow falling before the ceremony that […]

KUALA LUMPUR, 6 July 2022 – As the global economy continues to deal with unprecedented levels of disruption caused by the pandemic and the conflict between Russia and Ukraine, the convergence of energy security and food security issues has become a front-of-mind issue faced by policy makers and consumers alike. […]

KUALA LUMPUR, 23 June 2022 — Malaysia Global Business Forum (MGBF) ties up with scoutAsia to ensure that businesses are equipped with deeper regional insights. The past two years has seen a massive shift in the way businesses are conducted with digitisation, digitalisation and automation continuously being adopted to improve […]

KUALA LUMPUR, 25 May 2022 – The Malaysia Global Business Forum (MGBF)’s exclusive roundtable on ‘Security Concerns in Critical Value Chains’ was held in a hybrid setting yesterday at the Eastin Hotel Kuala Lumpur. The guest of honour was Yang Berbahagia Tan Sri Dato’ Seri Rafidah Aziz, former minister of […]

We live in the age of crisis. At the heart of any crisis is the threat of rapid change. Change too deep or too wide that the current coping mechanisms for an individual, corporation or government are unable to remain resilient. An unwelcome paradigm shift, like the proverbial spider, that […]