According to recent Suruhanjaya Syarikat Malaysia (SSM) data as per 2019, nearly 1.3 Million corporates and SMEs exist within Malaysia and are continuously growing. Banks are continuously trying their best to cater to these organizations (both new and existing) to ensure that the customer’s needs are catered to as efficiently as possible whilst keeping their costs low and manageable.

Organizations and SMEs when opening their company bank accounts continuously face administrative hurdles and risk resubmissions which can become tedious tasks to do. For a bank, analysing and manually addressing these documents is time consuming and prone to human error. All these aspects contribute to critical loss of time and money for both parties and thusly hinder both sides of the business not to mention the loss of potential opportunities.

The MoU between Codebase Technologies and Big Dataworks aims to reduce the time it takes to register corporate and SME bank accounts, effectively empowering the current banking infrastructure to bridge the existing gap. Codebase Technologies, is a leading Global Open API Banking solutions provider at the forefront of the emerging FinTech ecosystem enabling both conventional and Islamic banks and financial institutions. The collaboration with Big Dataworks, a known “positive ecosystem disruptor” and pioneer of various nationwide innovations, will now move demystify digital financial services for consumers in Malaysia and further-a-field.

The MOU entails the collaborative development of the APAC region’s first-of-its-kind eKYC offering based on Open API Banking principles for SME and Corporate Banking customers, which will set new industry benchmarks for corporate customer onboarding time and cut customer acquisition costs, by up to 60%+, for banks. The robust product will allow banks, financial institutions, and FinTechs to deliver seamless customer experiences by allowing corporate users to open a bank account within minutes with full STP processes backed by machine learning and data analytics.

Codebase Technologies will leverage its innovative and industry leading CX and Compliance offerings from its award-winning Digibanc™ suite to develop this unique offering while Big Dataworks will provide their cutting edge data connectivity as one of two data providers for SSM, the national database for company registration and annual accounts in Malaysia, raising the bar for enterprising tech partnerships in the region. A provider of Open API Banking software with a global footprint, Codebase Technologies supports financial institutions with its comprehensive suite of solutions including the onestop-shop ‘Bank in a Box’ Digibanc™. Solutions enabling areas such as customer experience and engagement, regulatory compliance and operations. Its unique integration platform, Digibanc™ Fintegrator, with 300+ out of the box banking APIs allows institutions to consume external financial and non-financial service providers via Open Banking APIs.

Codebase Technologies’ Managing Partner, Raheel Iqbal, commented, “This is an exciting and bold initiative that promises to set an industry standard for not just identity management and compliance in banking, but also for how synergetic innovation can maximise convenience within the lifestyles of daily bank users at a fraction of the cost. We are proud to continue Codebase Technologies’ tradition of progressive partnerships and aim to see ground-breaking advancements in the region’s financial industry.”

Big Dataworks’ CEO, Sheriza Zakaria, commented, “We’re excited to leverage our expertise in big data analytics along with world class offerings from Codebase Technologies to serve the Malaysian banking industry on such a large scale. This partnership promises to set a new standard for the potential of big data applications in finance.”

Services

STAKEHOLDER ENGAGEMENT

BUSINESS INTELLIGENCE

GOVERNMENT RELATIONS

BUSINESS & BROADER MARKET ACCESS

Upcoming Events

‘A WORKING LUNCH WITH NORDIN’: NATIONWIDE TOUR WITH TOYOTA

MGBF Roundtable: Digitalisation of the Food and Beverage Industry

THE SOUTH CHINA SEA: A THREAT OF DISRUPTION FOR BUSINESS?

FOOD SECURITY IN THE BREACH: INDUSTRIALISATION AND WEAPONISATION

MGBF In The News

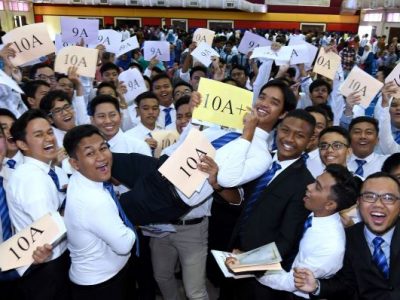

SPM and the Future of Data

MGBF Roundtable to shape Malaysia’s future in the digital economy

MGBF: Political stability to usher in new era for business

Death by a Thousand Algorithms

KSK Land recognised for investor attraction strategy

KSK Land set to drive further investment into Malaysia

A Need for Strategic Calm

With Change Comes Opportunity

MALAYSIA GLOBAL BUSINESS FORUM TIES UP WITH SCOUTASIA