Covid-19 may scare businesses, but M&As could shake those fears away

Kuala Lumpur, May 2021 – March 2020 is a month that will be remembered by every Malaysian, if not just for the next few decades but in history. Very few anticipated the severity of a flu-like disease that was making its way across borders and overpowering the immunity of masses worldwide. Covid-19 was indeed a shocker and it had a point to prove – that it is not easily defeated.

More than a year later, despite major efforts by leading scientists and medical practitioners, the pandemic is still lurking and at a high in many countries. Due to its brutality, it has not just affected the health and personal wellbeing of people, but it has left a very strong negative impact on businesses across the globe, especially Small and Medium Enterprises (SMEs) as well as Micro-Entrepreneurs. Malaysia was no exception.

This impact has affected many sectors across the economy. The Merger & Acquisition (M&A) market is no exception. It was reported that M&A activities in Malaysia fell for the third consecutive year in 2020, hurt by the impact of the Covid-19 outbreak. However, experts see a bounce-back for M&As towards Q4 this year as a solution for the troubled businesses that have been significantly wounded by the Covid pressure.

According to the Entrepreneurship Development and Cooperatives Ministry in a Parliamentary written reply dated Nov 5, 2020, a total of 32,469 SMEs had folded since March 2020 when the movement control order (MCO) was first implemented to curb Covid-19. The Ministry, quoting statistics by the Companies Commission of Malaysia (SSM), said that 9,675 SMEs shut down operations during the first phase of the MCO from March 18 to June 9. Then a further 22,794 SMEs shut down during the recovery MCO that took place from June till September last year, with the highest figure recorded in August with a total of 17,800 SMEs.

Others either suffered from having to offer pay-cuts to their employees or laying off staff, just to make ends meet.

However, this pandemic has taught many a lesson in business survival and lured them towards the necessity of M&As – as the old saying goes,

“receiving a piece of the pie is better than receiving nothing at all.”

Mergers and Acquisitions, despite the alarming sound of their title, brings many benefits to business owners. There are four common types of M&As in Malaysia: the acquisition of assets or business, acquisition of shares, joint ventures and total takeovers.

Cassandra Nicole Thomazios, Partner from MahWengKwai & Associates

– Cassandra Nicole Thomazios, Partner from MahWengKwai & Associates.

M&As are not just practical for SMEs, even larger firms have decided to take this proactive solution to benefit their organisations. The largest M&A deal last year, valued at US$2.72 billion, was in the agricultural sector. This was the planned takeover by the Federal Land Development Authority (Felda) of FGV Holdings Bhd shares as announced in December last year.

An example of M&As in the SME sphere is that of CTOS Digital Sdn Bhd, a company involved in credit reporting which recently acquired 100 per cent of shares in Basis Corporation Sdn Bhd in 2020 to expand their portfolio and for business growth as Malaysia’s leading credit reporting agency.

Raymond Mah, Managing Partner of MahWengKwai & Associates

– Raymond Mah, Managing Partner of MahWengKwai & Associates.

In an increasingly competitive and financially constrained environment like we are in now, corporate leadership must identify and pursue growth opportunities that will strengthen their organizations’ market position and financial performance. Growth strategies that include developing new service lines or markets, expanding existing service offerings and markets served, entering into joint ventures to develop or expand services/markets, are outweighed by the advantages of merging with or acquiring existing operations from competitors, or other providers.

Acquisitions can quickly and dramatically shift an organization’s position by improving accessibility to clients in new attractive markets as well as enhancing access in existing markets, fundamentally changing the market position by moving the organization from a subordinate position to a more dominant position, creating barriers that preclude the competitive entry into a market, facilitating reorganized service distribution and operations to significantly reduce the cost of delivering services as well as providing operational capacity for services at a lower cost in a better timeframe than would be required to create such capacity without an acquisition or merger.

Many organisations have also reported that an M&A move has enhanced their organization’s financial performance and credit rating, thereby improving access to capital and lowering the cost of capital.

To comprehend these strategic and financial benefits, businesses will need to assess their current ability to pursue M&As, and commit the time and resources needed to develop such capabilities, if currently limited or absent. Hence, connecting with legal experts who specialize in Merger & Acquisition deals would be a smart move for businesses, regardless of small or big, to secure a brighter and more sustainable future post-Covid-19.

If you seek legal advice on your business or have any inquiries on mergers and acquisitions, please visit www.mahwengkwai.com

-end-

Services

Stakeholder mapping, analysis, engagement and communication needs to be detailed to avoid business losses or even worse, a crisis. How can you do this effectively to prevent failure? ...

Data-driven business decisions have never been as crucial, especially in this era. MGBF leverages off, technology, experience and market presence to aid businesses in making accurate decisions. ...

MGBF provides comprehensive strategic advice and results-focused solutions to solve clients' problems in business-government relations so they can focus on their core business. ...

A critical business challenge is meeting the right decision-makers and potential buyers through the best channel and platform. How will you improve your business competency? ...

Upcoming Events

MGBF founding chairman Nordin Abdullah and UMW Toyota president Datuk Ravindran K. will delve into the convergence of automotive innovation and environmental sustainability in Penang, Sarawak, Johor and Pahang.

Hosted by menumiz™ – an end-to-end restaurant management system – this roundtable will feature a case study presentation and a panel session to discuss the latest digital trends, challenges, and opportunities within the food and beverage sector.

In this episode of 'A Working Lunch with Nordin', MGBF's founding chairman, Nordin Abdullah, will host this discussion focusing on the biggest threats and opportunities for businesses as we look to manage change in the South China Sea.

This MGBF Roundtable will focus on regional food security issues and trends in the regional supply chain, and trade regulations and policies, including a new geopolitical tool i.e., weaponisation of supply chains.

MGBF In The News

Planet QEOS, KIS BlOCNG San Bhd, and the Sarawak Land Consolidation and Rehabilitation Authority (SALCRA) have officially signed a tripartite memorandum of understanding (MoU) to establish a collaborative framework aimed at producing bio-hydrogen via the Steam Biomethane Reforming (SBMR) Process. The MoU was signed by Planet QEOS executive chairman Dino […]

Planet QEOS and China Machinery Engineering Corporation (CMEC) are interested in investing RM10 billion to co-develop advanced Megawatt peak (MWp) agrovoltaic in Baram, to further boost Sarawak’s green energy initiative and food security. Sarawak Premier Datuk Patinggi Tan Sri Abang Johari Tun Openg was briefed on Friday by both the […]

Last week SPM results came out, 373,974 aspirants who have been waiting patiently over the last few months would now know their fate. Some 10,109 have received all A’s, the golden standard of academic success and the ticket to those looking to study the “more advanced” subjects in university. Proudly, […]

The classic knee-jerk reaction is to say, fire the coach, change the leadership of associations, and reduce the funding till they start performing better. This kind of negative reinforcement may work for kindergarten children, but we are dealing with high-performance adults – individuals much further along in their psychological and […]

Since its earliest tea plantations in 1929, Cameron Highlands has grown to become a key player in the agricultural landscape of Malaysia, producing 40 per cent of all vegetables grown. Despite Malaysia shifting its economic focus away from agriculture, the industry remains imperative for food security and the livelihoods of […]

Although at first glance the travel industry and the agricultural sector appear to have nothing in common, they actually share more than meets the eye. The economic benefits of tourism to the agricultural sector can be multiplied several times over. “Tourism brings the end consumers closer to the source, which […]

The Malaysia Global Business Forum (MGBF) recently held a high-level roundtable themed ‘Designing the Future of the Digital Economy’, attended by industry leaders and business associations. The guest of honour was Yang Berhormat Syerleena Abdul Rashid, the Member of Parliament (MP) for Bukit Bendera in Penang. The MP’s Special Session […]

The Malaysia Global Business Forum (MGBF) will be hosting a roundtable on ‘Designing the Future of the Digital Economy’ on 23 February 2023. It is the culmination of the first three MGBF Exclusive Roundtable Series titled ‘The Evolving Threat Matrix in the Digital Economy’ held throughout 2022. According to the […]

The Founding Chairman of the Malaysia Global Business Forum (MGBF), Nordin Abdullah, today spoke on Bernama TV’s leading English talk show, The Brief, hosted by Jessy Chahal, on the topic of a stable political reality and what that means for the Malaysian economy. Nordin said, “The first thing that it […]

More than 1,100 years ago, Muhammad ibn Musa al-Khwarizmi was developing the mathematical formulas that we know today as algorithms which now have become so intertwined with the business fortunes of global media giants and the very fabric of geopolitics. A series of recent high level international reports have revealed […]

KSK Land has been recognised by the Malaysia Global Business Forum (MGBF) for its role in attracting high net-worth individuals to Malaysia post-pandemic. The first challenge in investor attraction is “selling” the country. In the context of Asia, Malaysia is competing with some very established investment destinations. The second […]

Malaysia, in particular Kuala Lumpur, continues to position itself as a regional centre to do business, educate a family and enjoy a global lifestyle. One company, KSK Land, has taken the lead in positioning itself and the city of Kuala Lumpur as a property investment destination for the global citizen […]

The upcoming budget represents an opportunity to build resilience in the critical sectors that will form the backbone of the country’s future-facing economic ambitions. This however needs to be achieved in the context of managing the community sectors most impacted by COVID-19 over the past two years. The Keluarga Malaysia (Malaysian Family) […]

Malaysia Global Business Forum (MGBF) has moved to support the creative economy as the overall economy moves into a recovery phase following the COVID19 pandemic. As a step in the direction of normalcy, the MGBF has agreed to host the art exhibition “I Know You’re Somewhere So Far” by one […]

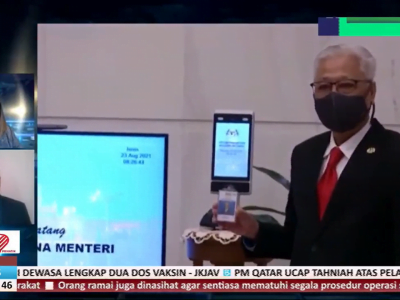

Congratulations to Datuk Seri Ismail Sabri Yaakob for taking up the mantle of the ninth prime minister of Malaysia. There is nothing normal about the situation; it could not have been scripted but it has kept the spectrum of media, mainstream and social, gripped. The first order of business for […]

In a stirring speech to the nation, President Joseph R. Biden, Jr. stamped his brand of leadership on the presidency, in his first act as the 46th president of the United State of America, it signaled several shifts. Perhaps the weather was foreboding with snow falling before the ceremony that […]

KUALA LUMPUR, 6 July 2022 – As the global economy continues to deal with unprecedented levels of disruption caused by the pandemic and the conflict between Russia and Ukraine, the convergence of energy security and food security issues has become a front-of-mind issue faced by policy makers and consumers alike. […]

KUALA LUMPUR, 23 June 2022 — Malaysia Global Business Forum (MGBF) ties up with scoutAsia to ensure that businesses are equipped with deeper regional insights. The past two years has seen a massive shift in the way businesses are conducted with digitisation, digitalisation and automation continuously being adopted to improve […]

KUALA LUMPUR, 25 May 2022 – The Malaysia Global Business Forum (MGBF)’s exclusive roundtable on ‘Security Concerns in Critical Value Chains’ was held in a hybrid setting yesterday at the Eastin Hotel Kuala Lumpur. The guest of honour was Yang Berbahagia Tan Sri Dato’ Seri Rafidah Aziz, former minister of […]